CFA Exam Level II Passing Strategies

Is passing CFA Level II doable? Absolutely. If you can correctly answer 33 questions in each session of the exam, you'll be on your way to passing.

You’re dedicating yourself to studying, but what is your target? The better you know your target for the CFA Level II exam, the more productive your studying will be and the higher your chances of success.

Focus on What You Can Accomplish

There are a total of 88 questions in the CFA Level II exam: 44 questions in the first session and 44 questions in the second session. To pass this exam, aim to answer at least 75% of these questions correctly. That means you need to correctly answer at least 88(0.75) = 66 questions total, or about 33 questions in each session. The key is to identify these 33 questions in each session of your exam and solve them correctly.

Once you start the exam, your most valuable resource is time—and you’ll want to use it wisely.

You must be willing to skip a problem.

There is no point in spending too much time on a single problem, then ending up with insufficient time, leading you to make careless mistakes on easier problems that you would have been able to answer correctly if you weren’t rushed. Keep in mind that all questions in the multiple-choice exams count the same. Solving a very easy problem correctly gets you as many marks as solving a very difficult problem correctly.

Remember that your goal for the exam is to answer enough questions correctly to pass. Once you start the exam, your most valuable resource is time—and you’ll want to use it wisely. Why bother spending 6 minutes wrestling with a difficult question that you might not even answer correctly anyway when you can use those 6 minutes to solve 2 or more easier questions?

Conduct a 10-second assessment.

Before you start a question, quickly follow these three steps:

- If you don’t understand the problem during the first read, skip it.

- If you think that the question is manageable, but that it could take some time to come up with the correct answer, mark it and skip it.

- If you understand the question and think you can solve it quickly, answer it right away and move on.

Apply this strategy to all the questions during your first pass through the exam. After that, come back to the questions you’ve marked and attempt those questions in your second pass. Finally, answer the questions you have skipped as best as you can. You’ll feel more relaxed knowing that you’ve already answered the easier questions. And if you’re really pressed for time, you can even make a random guess. You won’t lose marks for incorrect answers, so a guess is better than no answer at all.

If you’re comfortable with at least 33 questions out of the 44 problems in each session, you should be able to pass the exam! In reality, you will likely need to know the answer to fewer than 33 questions out of the 44 questions to pass the exam. But it’s good to have a target in mind.

A passing score is within your grasp!

Passing Might Be Easier Than You Think

What score do you need to pass the CFA Level II exam? Unfortunately, the CFA Institute doesn’t give an exact number. They do give enough information to determine a reasonable estimate, but rather than debate the unknowable, we are going to assume a 75% passing score. It is on the conservative side, but not by much.

If 75% is required to pass, then you need to answer 66 questions correctly. You may think you need to know the answer to 66 of the questions, but that is not the case. You really need to know the answer to fewer than 66 questions, as we will illustrate below.

First, let’s divide the questions into three categories.

- For Category 1 questions, you know the answer. You love these questions and feel confident when you’re answering.

- For Category 2 questions, you’re not quite sure of the answer, but you can eliminate one of the options. You might spend a lot of time on these questions because you are familiar with the topic but can’t quite determine the answer.

- For Category 3 questions, you have no idea, so you must randomly guess. These are the ones you think come from some other syllabus!

Second, consider the probability you’ll answer correctly.

Now let’s think about the probability of getting the correct answer for each question category. Since you know the answer for Category 1, you have a 100% chance of getting it right. For Category 2, let’s use 50%, which is consistent with being able to eliminate one of the three choices. Finally, answers to Category 3 questions have just a 33% chance of being correct.

Remember you need 66 correct questions to pass. You can determine how many questions you must know (Category 1) if you assume how many questions fall into Category 2. For example, assume 30 out of the 88 questions fall into Category 2. That means you will be familiar with a little more than a third of the questions but not know the answer for sure.

Then you can solve for how many questions you need to know with the following formula:

- 66 = (100%)(Category 1) + (50%)(Category 2) + (33%)(Category 3)

- 66 = (100%)(Category 1) + (50%)(30) + (33%)(88 – 30 – Category 1)

- Category 1 = {66 – (50%)(30) – (33%)(88 – 30)} / 0.67 = 48

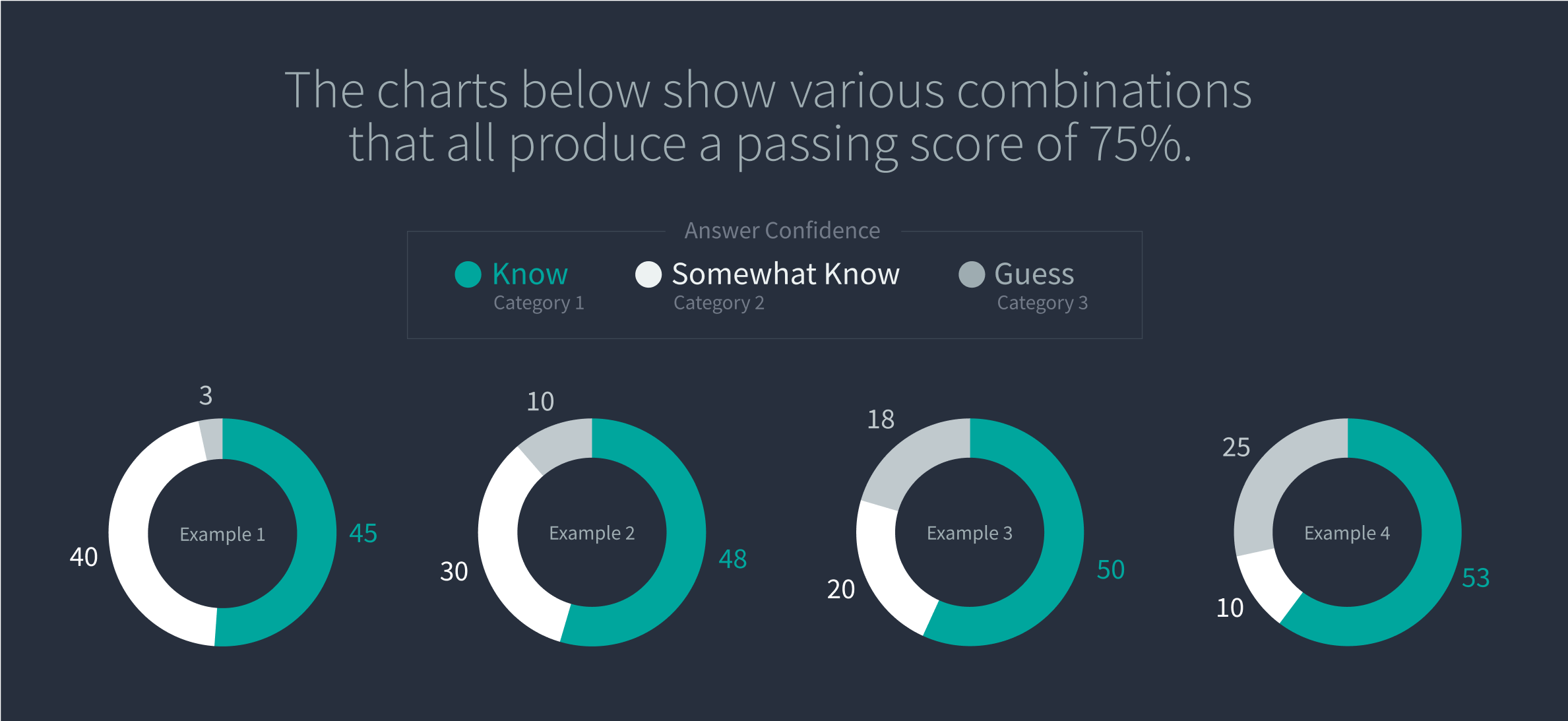

So if you somewhat know 30 of the 88 questions, you only need to know 48 of the 88 questions for sure. That means you can randomly guess on 10 questions. The table below shows various combinations that all produce a passing score of 75%.

If you need to correctly answer 66 questions to pass the exam, you don’t have to know the answer to 66 questions. That should give you confidence. It’s OK to guess on some questions. A passing score is within your grasp!

You're on your way to passing the Level II CFA exam.

Our team is committed to helping you pass your CFA exam. Contact us if you have any questions about the exam or our CFA learning experience.